4QFY2018 Result Update | HFC

May 10, 2018

Dewan Housing Finance Ltd

BUY

CMP

`625

Performance Highlights

Target Price

`740

Particulars (` cr)

4QFY18

3QFY18

% chg (qoq)

4QFY17

% chg (yoy)

Investment Period

12 Months

NII

667

626

7

536

25

Pre-prov. profit

610

562

9

459

33

PAT

313

306

2

249

26

Stock Info

Source: Company, Angel Research

Sector

HFC

Dewan Housing Finance (DHFL) posted an impressive operating performance yet

Market Cap (` cr)

19,580

again in 4QFY18. The HFC’s business grew in the quarter with a 28% yoy rise in

Beta

2.3

loan book to `91,932 cr. In line with it, AUMs also increased by 33%yoy in the

52 Week High / Low

680.6/387.2

quarter. At the bottom line, the company’s net profit grew by 26%, aided by steady

Avg. Daily Volume

4,40,992

growth of 25% in net interest income, a surge of 70% in other income and a

Face Value (`)

10

BSE Sensex

35,216

reduction in cost with respect to income, which decreased by 120 bps to 25.4%.

Nifty

10,718

Asset quality intact even when advances surge

Reuters Code

DWNH.NS

Bloomberg Code

DEWH.IN

During 4QFY18, the company’s AUM grew by 23%, 57%, 42% and 61% in home

loans, LAP, corporate loan and SME loans, respectively. Aggressive growth is

witnessed in LAP as the interest rate is higher than that of home loans. This

Shareholding Pattern (%)

increasing concentration on LAP helps the NIM to be at 3% even with competitive

Promoters

39.2

rise in total loans and other assets. Off balance sheet, AUM stood at 17% of total

MF / Banks / Indian Fls

9.5

AUM as of 4QFY18. The company’s loan book also increased simultaneously. On

FII / NRIs / OCBs

20.5

yoy basis, disbursements and sanctions spiked by 85% and 81%, respectively.

Indian Public / Others

16.3

Added to this, borrowings increased by 11.3%, while the cost of funds was almost

same. The mix in borrowing remained largely unchanged with banks accounting

for 42% of total borrowings, followed by capital markets (40%) and others (18%).

Abs. (%)

3m 1yr

3yr

Even when the loans and advances soar, DHFL is careful about its asset quality.

Sensex

2.0

17.0

30.0

The company maintains an excellent asset quality with GNPA at 1% of the

DHFL

9.4

102.7

153.3

advances and NNPA at 0.5% at the end of 4QFY18. The company increased

provisions by 57%yoy and 30%qoq.

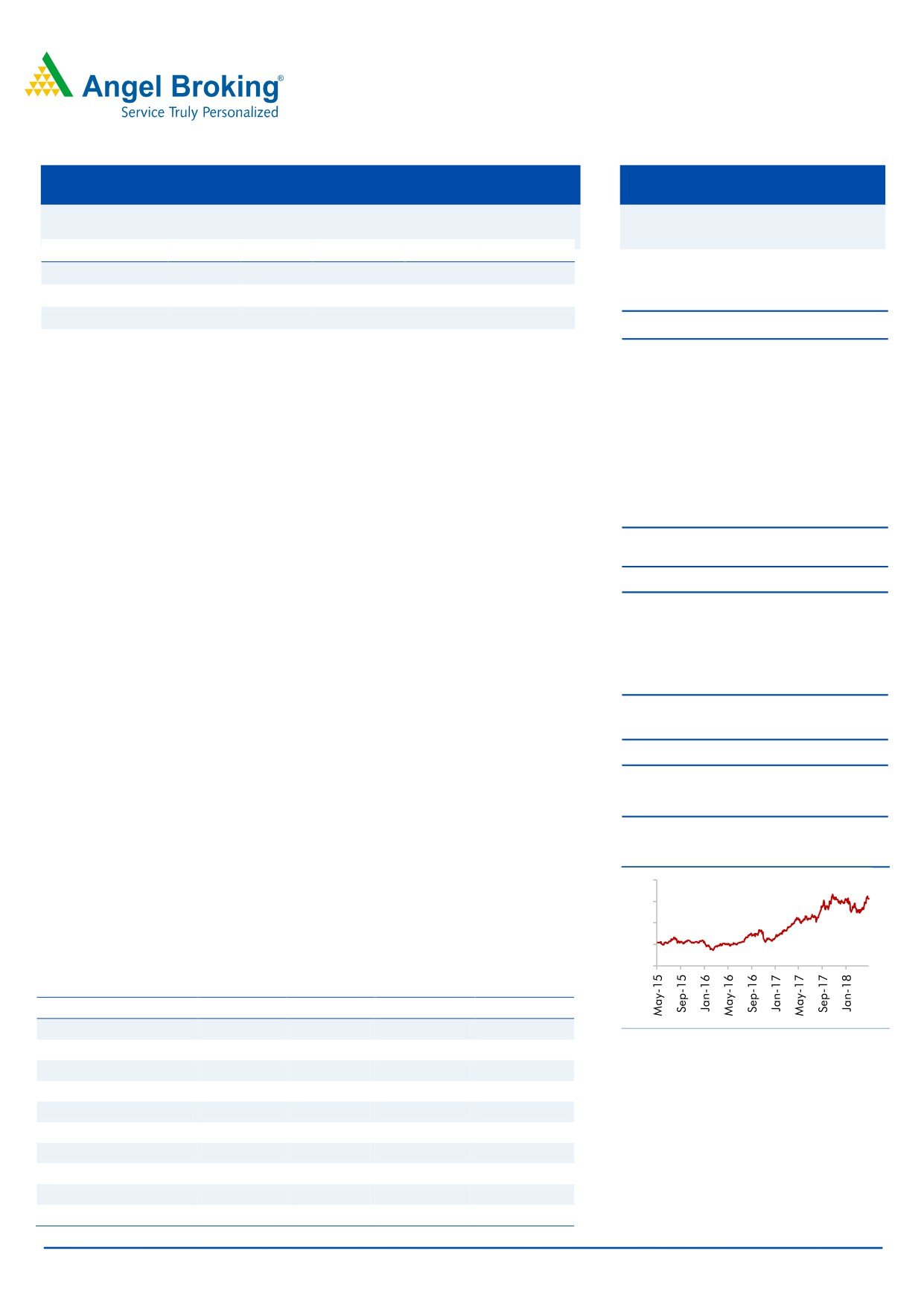

3-year price chart

Outlook & Valuation: We expect the company to post a healthy loan book CAGR

800

of 28.5% over FY2017-20E, which is likely to translate in earnings CAGR of 28%,

600

over the same period. At the current level, the stock is valued at 1.8x FY2020E

400

ABV. We maintain BUY on the stock, and retain our target price of `740.

200

0

Key financials (Standalone)

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2012E

NII

1,859

2,460

3,114

3,789

Source: Company, Angel Research

% chg

25.5

32.4

26.6

21.7

Net profit

927

1,174

1,565

1,931

% chg

27.1

26.7

33.2

23.4

NIM (%)

2.3

2.5

2.6

2.5

EPS (`)

29.6

37.4

49.9

61.6

P/E (x)

21.3

16.8

12.6

10.2

P/ABV (x)

2.5

2.3

2.1

1.8

Jaikishan Parmar

022 - 39357600 Ext: 6810

RoA (%)

1.3

1.3

1.4

1.4

RoE (%)

14.4

14.0

16.6

17.8

Source: Company, Angel Research; Note: CMP as of May 10, 2018

Please refer to important disclosures at the end of this report

1